As we bring 2017 to a close, I find myself reflecting on the year and wondering how things are about to change for us 99%ers. Regardless of all the things that are happening on our national stage, I absolutely know one thing for sure. The most important thing you can do to protect you and your family is get your personal finances under control. If you don’t do it willingly, I suspect you may be forced into it via economic changes that could be around the corner.

The great news is, you can get in front of this by making a few simple adjustments to your personal finances. First things first, you need to sit down and spend some time making a budget (or spending plan if you want to be fancy). Writing out a budget is a powerful statement that works on your subconscious. Even if you fall off the budget wagon once in a while, putting your numbers and goals in writing increases the likelihood that you’ll make better money management decisions. It’s also important to remember that if you don’t measure it, you can’t manage it.

Second, make a commitment to live within your means. Don’t spend more than you earn. Period. If that means you have to cut back on your cell phone data plan or the number of channels your cable TV package has in it, so be it. Believe me, no TV show is worth wondering if you’ll have enough money to pay the rent next month, put a tire on your car if you get a flat or take your little one to the doctor when they are sick.

Third, make sure you save a consistent percentage of your income. This is a critical commitment to make. Why is that? Because, it’s not what you earn, it’s what you save. Any financial person worth their salt will tell you these are words to live by. If you can automate your savings, even better. Make SURE to save at least something every month. It doesn’t have to be a huge amount to begin with, just making the habit is a powerful small action that will pay off in spades in the long run. If you are lucky enough to have a job that has a 401(k) or other retirement plan, enroll in it immediately if you haven’t already and contribute the maximum amount you can afford.

Fourth, decide right now to stop getting into debt. If you can’t pay for it outright, seriously consider whether or not you really need it. You may say, “what about groceries or gas?” The truth is you shouldn’t be paying for consumables with credit cards anyway. The only exception to that rule is if you pay your credit card off every month. If you have any debt, which many of us do, commit to paying off the debt with the highest interest rate as soon as possible, then move on to the next one with the highest interest rate until you’ve paid all your debts off. It may take some time but I did it, and you can, too.

Fifth, make sure you are not just saving your money but investing it. Don’t forget how important compound interest is! It’s how librarians and plumbers become millionaires! If you aren’t sure about how to invest. Get on the phone with someone at Vanguard and open a Roth IRA as soon as you can. Believe me, it’s easier than you think!

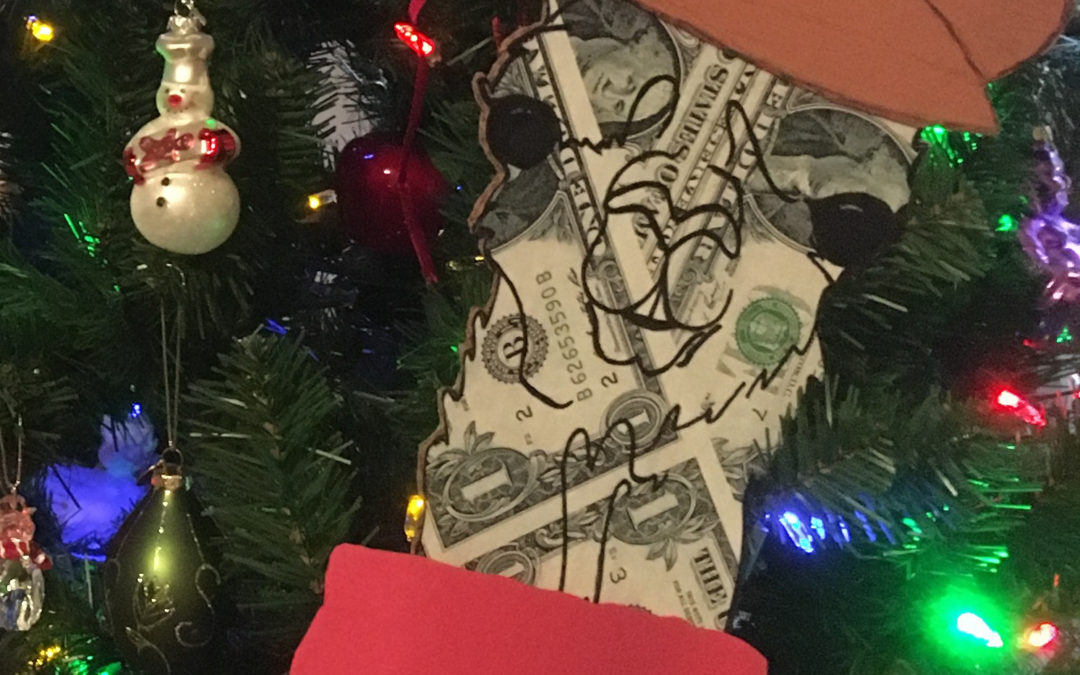

These are very simple things that you can do to start protecting yourself if the economy hits the skids in 2018. It’s also important to remember that if you and your family are healthy and safe, with housing and food and all the other comforts we have in this great country… well, you are already way, WAY ahead of the game. That, my friends, is the best Christmas gift of all!

Happy Holidays!

The Dollar Lama (as Tiny Tim!)

P.S. Make sure you check out my online courses, books and resources, too! Investing in your money management education is an investment in yourself. That’s the best investment you’ll ever make, I guarantee it! Don’t forget my weekly Facebook live videos on Facebook.com/newcashview, Instagram @joyalfordbrand and on my YouTube channel NCVTV. You can catch me twice, on Mondays between 3:00 p.m. and 4:00 p.m. for my Monday Money Management Minute and Thursday evenings between 7:00 and 9:00 (Eastern Standard time), for my weekly NCVTV episode. They are packed full of useful and entertaining money management information! If you’ve missed any NCVTV episodes, you can see the latest on newcashview.com or you can check out my YouTube channel and get caught up! You can get there by clicking here. Remember, like and share the NCVTV videos on Facebook and all your social media platforms, so others can benefit from them, too!

GET INSTANT ACCESS

Download your FREE gift!

To learn 5 Student Loan Debt Payment Tips, enter your info and click on download.

Check your email for FREE gift download!