May’s NCVTV episodes started out with one of the most important, yet rarely included, topics in personal finance and that is gratitude. I can’t stress enough how important gratitude is to successful money management. After that, we shift gears into discussing student loan debt. Since it’s graduation season all over the United States, I can’t think of a better topic to dive into than student loan debt management!

Episode 10 – An Attitude of Gratitude

Thank you, thank you very much!

Without question, I know for sure that every sound money management plan has a gratitude component. In fact, I’ve said this before and I’ll say it again, if you are not spending time every day making an effort to be grateful, you will continue to wither, either financially or in your ability to enjoy your life and/or your money. A gratitude practice is a must. I’ve found it to be true for me and I know it’s true for you, too.

If you don’t have a financial gratitude practice and you have no idea how to get started with it, here are a few things to think about. First, it’s not rocket science and it’s not complicated. Start with your favorite color or food and just sit for a minute or 2 thinking about how thankful you are that you get to enjoy tacos or clean socks. It doesn’t have to be something huge. To start off, a little thing will do. Second, A gratitude practice doesn’t take long. All you have to do is take a few minutes, while you are driving or brushing your teeth and start listing out the things you are grateful for.

A gratitude practice doesn’t just help you feel more abundant. It does some other things, too. First, it changes your focus. If you are thinking about what you have to be grateful for, you are no longer focusing on your problems or the negativity in your life. It gives you a little space from the situation so you can take a breath and relax a tiny bit. When you are practicing gratitude, you begin to see that the problem is not really a problem but a sort of lock and key, an opportunity to learn something. There is no experience that does not contain a lesson and looking for it opens the lock.

Finally, the practice of gratitude eventually gives you perspective in so many ways. Perspective is a natural by-product of gratitude. You can’t practice gratitude and not gain perspective revealing your true priorities. This is especially important when you are trying to get your finances under control! Also, when you practice being grateful for what you have, you begin to become aware of more things to be grateful for. It doesn’t get any better than that!

To watch the episode, click here.

For More In Depth Information

If you want to more personal finance tips and strategies, including 5 Student Loan Debt Payment Tips, enter your information and click on "Learn More!"

Check your email for FREE gift details!

Episode 11 – Argh! Student Loans

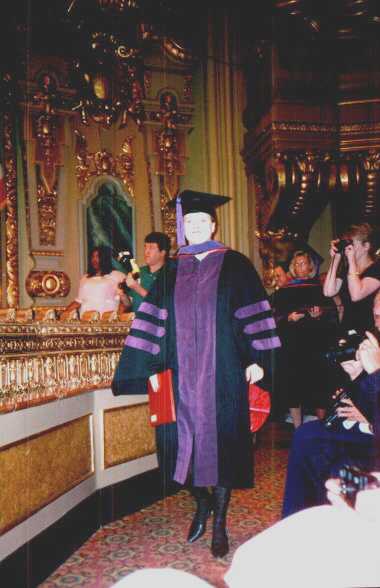

This episode is the beginning of a series on episodes on student loan debt, something I see effecting more and more people negatively, on a daily basis. We all know how important education is. My parents made it clear that to be successful in life, I needed to get an education. Of course, while I do think it’s important to get an education, I also understand it doesn’t guarantee that you’ll be automatically successful in life. In fact, I know that there are many ways to be successful and earn a great living and college isn’t appropriate for everyone. I don’t know about you, but I’m thankful for those people who serve in the military as enlisted personnel or pursue any other numerous career paths that do not require a college degree.

It’s also important to understand that college degree also does not guarantee a high paying job. This is something I have a lot of experience with. When I tell people I’m a lawyer, I get hit with instant stereotypes. People typically believe that I make far more money as an attorney than I ever have. It took me months to find a job and it paid about $30,000. Barely enough to survive on. Then it took years for me to break $50,000. On top of that, I had 6 months after graduation before my first student loan payment came due. As a result, I was the most educated server at the Outback Steakhouse in Raleigh, North Carolina for the better part of a year before I finally landed a job practicing law.

In order for you to understand just how much I know about student loan debt, I spend a fair amount of time in this episode talking about my own fun student loan debt saga. Believe me, It’s a real thrilling epic! Even though at the time, I had no clue about the student loan debt world, I was lucky enough to make some smart choices that did ease my burden a little bit. One of the smartest things I did was choose schools I could commute to. That meant 2 things, first, I picked in state, public universities. Second, out of the 7 years I was in college and law school, I only lived on campus for 1 year. As a result, I was able to take out the smallest amount of loan money possible which eased my burden after graduation.

One thing I did understand was that I would have to pay back anything I borrowed and I had no guarantee of a job. That was terrifying! I basically struggled and struggled, living paycheck to paycheck without any relief until my thirties when I finally managed to pay off my credit card debt. That’s when things started to slowly get better for me.

My goal with this series of episodes is to help as many people as possible figure out how to make smart decisions about student loans and how to manage the student loan they have a little better. Also, if someone you know, is getting ready to graduate from high school and head off to college, I would encourage them to go back and watch NCVTV episode 3 which is all about how to think about credit. I talk about the true value of a college education as well as how interest works. Finally, a few quick suggestions I would make to new graduates about student loan decisions include the following:

- Consider starting out at community college. Get your Associate’s degree first and then go to a University to complete your Bachelor’s degree. Of course, this may not be practical for everyone, especially if you have your heart seat on getting a specialized degree but, being flexible in how you approach your college education can save you lots and lots of money.

- 3 words… LIVE AT HOME. You can either live at home while you are going to college is better than living at home for the eight years after college while you try to find a job in your field while waiting tables and making your huge student loan payment.

- This one is for the parents, and I realize this will not be popular with every parent out there but, I hope you know I’m saying it out of love. Don’t say “I want my kid to have the college experience,” unless you can write a check for it or you are willing to co-sign on all the debt (if that’s the case, see #4 below). Instead, spend time helping the child figure out what is the best path for him or her, that could take a while but it will be the best thing for them, in the long run.

- This one is also for the parents. Beware of cosigning for student loan debt for your child. Don’t co-sign on anything for anyone unless you are comfortable with paying the debt in full because you may very well end up doing that. Also, student loan debt is generally not dischargeable in bankruptcy.

To watch the episode, click here.

Episode 12 – Student Loan Starting Point

This episode is all about the current world of student loan debt. It’s such a confusing and vast topic that it’s hard to know where to start unraveling it. So, let’s start out with some statistics. Nationally, we are at about $1.4 trillion, in total student loan debt. That’s about $600 billion more than our total, national credit card debt. The average amount of student loan debt per person is about $37,000 and the average student load debt per household is $49,000. We, as a nation, owe far more student loan debt than even car loan debt.

There are two significant problems with student loan debt. First, going to college in the United States has become ridiculously expensive. Tuition has increased at least 300% since 1995. This is a significant increase, even if you factor in inflation. It’s becoming outrageously expensive to get a college degree causing people to go into a lot of debt in order to get a college degree. If you haven’t watched it yet, check out episode 11 where I talk about my perspective on student loans and episode 3 where I talk about interest and the value of debt.

The second problem with student loan debt is that student loans get shifted over to private servicers who are mostly for-profit and have been less than careful with student loan accounts. That is such a huge issue that I intend to keep talking about it in future episodes but for now, just know that you can’t rely on student loan servicers to act in your best interest when it comes to your student loan debt.

student loan debt can be conquered and that process starts by you making a commitment to getting it under control. I want to help you make that commitment, figure out your situation and get you pointed down the path to being student loan debt free. To that end, my student loan content falls basically 2 categories. The first category is for people who are either getting ready to go to college or are still in college. The second category is for those people who are already done with school and have student loans that they are trying to get sorted out.

- You need to be mindful of your student loan debt. That means that if you are just now graduating from high school and getting ready to go to college, make sure you are carefully choosing your career field. It may be wise to choose degree that stands on its own that and opens up as many career opportunities as possible, rather than a broad, general degree.

If you are done with your degree, being mindful of your student loan debt means first and foremost, making your payments on time every month and keep tabs on your servicer. Get your statements and look at them every month. Make sure you are double checking them and that they are accurate. You need to take responsibility for making sure your account information and balances are accurate!

- One thing you should be aware of is that there are slim exceptions to the non-dischargeability of student loan debt in bankruptcy (whether it’s government or private loan debt). I would encourage you to find a good bankruptcy attorney near you and talk to them about whether or not you are a candidate for bankruptcy and whether or not your student loans meet the dischargeability test.

- Finally, don’t fall victim to one of the many scams that are out there claiming to help with student loan debt. Beware! If is sounds too good to be true, it probably is. You generally should not be paying any money to anyone to help you resolve your student loan debt. Whether they are asking for it up front or in installment payments.

Of course, I encourage everyone to get an education, just be smart about it and don’t rack up student loan debt you can’t pay off in a reasonable amount of time.

To watch the episode, click here.

Episode 13 – The Truth About Student Loan Forgiveness

Please, please forgive me!

Ah, student loan forgiveness. Whenever I think of it, I think of Bigfoot , the Abominable Snowman or the chupacabra, something talked about, but never really seen. The truth is, there is such a thing as student loan forgiveness and discharge, you just have to know where to look and be smart about it. There are lots of scammers out there trying to exploit people who need help with their student loans This episode is all about what to look for and how to avoid scams.

So first and foremost, my tip for managing your student loan debt is do not pay anyone to help you figure out what kind of relief you are entitled to. Of course, this is for people who have already graduated and have loans have come in to repayment. If you want to know whether or not you qualify for some kind of relief for your student loans, spend a little time educating yourself about what your options are by doing a little Googling. For some programs, you can sign up online yourself. If you can fill out a FAFSA form, you can do your own loan forgiveness paperwork yourself. Don’t pay anyone to do it for you. Remember, if it sounds too good to be true, it probably is! To help you get started, I’ve put some information together to give you a starting point. You can see the links to different programs, as well as other student loan debt information, by clicking here.

There’s another source of relief that can help disabled people with student loan. A lot of people who might qualify aren’t aware of this program so I want to raise the visibility of it as much as possible. If you can prove your disability and otherwise qualify, you can apply for a Total and Permanent Disability Discharge (TPD) through several different agencies. Incidentally, this works for disabled veterans, too. If you think you may qualify for this type of student loan discharge, check out this link for more information. This forgiveness program also has it’s own website. You can check it out by clicking here.

Let’s spread the word about the resources that are out there for student loan debt relief and work to get this problem under control. I’ll be posting more content with helpful information as often as possible to help you figure out the best course of action for your situation. Please share it with others so they can get the relief they need, too.

To watch the episode, click here.

These are the highlights of all the NCVTV episodes for May 2017. Make sure you check them out on my YouTube channel! I’ll see you there!

Sincerely,

Joy Alford-Brand

Your Dollar Lama

GET INSTANT ACCESS

Download your FREE gift!

To learn 5 Student Loan Debt Payment Tips, enter your info and click on download.

Check your email for FREE gift download!